Summary of Lifetime Allowance Abolition - what, how and why?

21 February 2024, News

The PLSA’s Lifetime Allowance Abolition Policy Insights Webinar on 6 February 2024 invited Isabel Freedman, Policy Advisor, HMRC, and Tim Smith, Professional Support Lawyer, Eversheds Sutherland, chaired by James Walsh, PLSA’s Head of Member Engagement, to talk to members about the changes and what they mean for schemes and their members.

SIX KEY POINTS ON THE CHANGES

- Abolition of Lifetime Allowance (LTA):

The Government announced the removal of the LTA framework from pensions tax legislation starting from 6 April 2024.

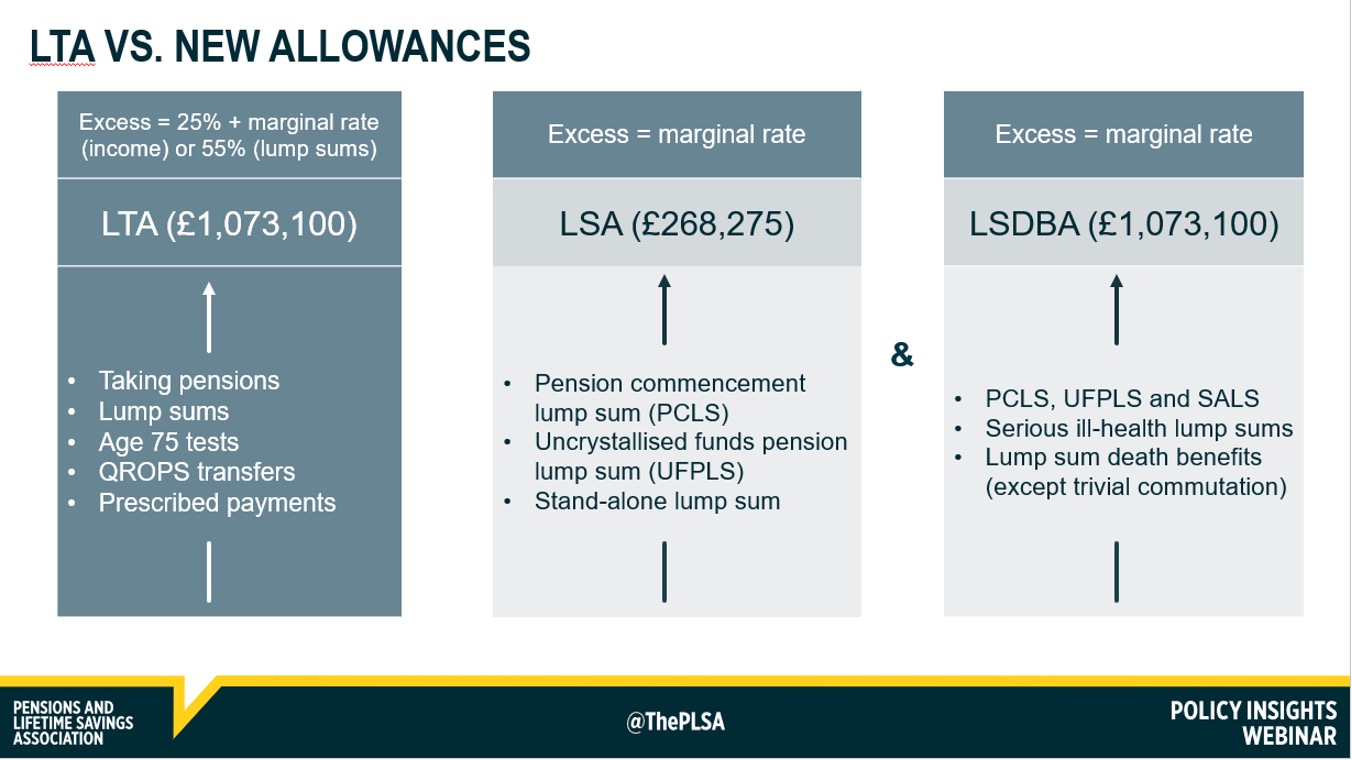

- Introduction of New Allowances: With the removal of the LTA, two new allowances are introduced - the Individual’s Lump Sum Allowance (LSA) and the Individual’s Lump Sum and Death Benefit Allowance (LSBDA). These allowances aim to limit the total amount of tax-free lump sums that individuals can receive from their pension savings. There has also been the removal of benefit crystallisation events (BCEs) and replacement with relevant benefit crystallisation events (RBCEs).

- Pension Commencement Excess Lump Sump (PCELS): As HMRC’s policy intent is to ensure that individuals who have crystallised benefits above £1,073,100 can continue to commute more of their pension as a lump sum when they retire, they are introducing the new authorised lump sum – the PCELS – after unintended consequences of the proposed changes to the Pension Commencement Lump Sum (PCLS) were highlighted to them. Issues exist with the PCELS so HMRC will be bringing forward legislation via regulations, effective from 6 April 2024, which removes the “permitted maximum” for the PCELS; and enables a PCELS to be paid where an individual has exhausted either their lump sum allowance or their lump sum and death benefit allowance. HMRC are aware of concerns about the consequences of connecting the PCELS with the commencement of a relevant pension. As they do not believe there is sufficient time to address this before April 2024, they have said that the PCELS will remain payable only where an individual becomes entitled to it in connection with becoming entitled to a relevant pension.

- Overseas Transfer Allowance: A another new allowance, the Overseas Transfer Allowance (OTA), is introduced to limit tax-free transfers overseas for individuals.

- Reporting Requirements and Transitional Arrangements: Changes to reporting requirements have been introduced to reflect the new allowances. Transitional arrangements are in place for individuals who have already taken pension benefits before 6 April 2024.

- Further changes: There will be further legislative changes made through regulations, where the legislation laid in the Finance Bill doesn’t work as intended. These will be introduced ahead of April.

- Pension commencement excess lump sum (PCLS)

- Reportable event 24

- Minor changes to other aspects of the legislation.

EXTRACT FROM THE WEBINAR

In reference to the further legislative changes:

“We do understand the challenges to timelines that poses for industry and whilst the government has been clear that they will be abolishing the LTA from April 24, they've also been clear that [HMRC] should be doing whatever we can to support [schemes] to get ready for that change,” said the HMRC’s Isabel Freedman.

The PLSA’s James Walsh asked for clarity on the timing of when the regulations to adjust the legislation will be laid.

Isabel Freedman responded: “We can't lay those regulations until we've got Royal Assent of the Finance Bill. They will be laid in time for them to become effective from 6 April 2024. We're looking currently at laying those in early March, when we expect we should have got Royal Assent of the Finance Bill.”

RESOURCES

- HMRC’s pensions email inbox for queries: [email protected]

- HMRC providing fortnightly updates via its pension schemes newsletter and LTA specific newsletters here.

- HMRC have said they are working to get draft guidance of the pensions tax manual.

- PLSA’s contacts:

Watch the recording of the Lifetime Allowance Abolition Policy Insights Webinar and read a Q&A with answers from HMRC.