One in five of retired people who used property to finance retirement felt they had no choice

20 October 2016, Press Release

The Pensions and Lifetime Savings Association (PLSA) has released the first findings from new research looking at how 35-85 year olds currently use or plan to use property to fund their retirement.

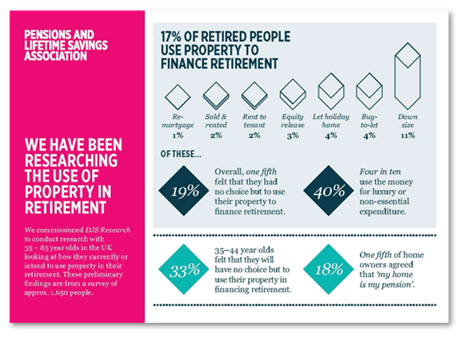

Our research suggests there are approximately 2 million people in the UK1 who have used their property to finance retirement. Within this group downsizing was the most popular with 11% choosing this option. Buy to let and letting holiday homes, at 4% each, came next. Re-mortgaging was the least common choice at 1%. While many of this group (40%) have used property to fund luxury or non-essential expenditure, one in five (19%) felt they had no choice.

Younger people are more likely to think of their property as part of their retirement planning. Of the 6 million people in the UK who are not retired and home owners with a mortgage2, 53% thought their home would play a part in financing retirement, even though 13% don’t expect to pay off their mortgage before they retire. 33% of 35-44 year olds feel they will have no choice but to use their property to finance retirement.

Across all age groups though, there was little support for the commonly-heard phrase ‘my house is my pension’. Only 18% of people agreed with this statement.

73% of those who had used their property to finance their retirement told us they felt they had made the right choice and 55% of those who released capital from their property told us they had put it into savings.

Joanne Segars, Chief Executive, Pensions and Lifetime Savings, commented:

“Retirement simply doesn’t look like it used to – the lines are blurring between work and retirement, between pensions and other forms of saving. Pensions, even great workplace pension schemes, don’t operate in isolation any more. They interact with other savings, and as an industry we need to adapt in order to help savers adequately prepare for retirement. That’s why we’ve done this research into how people use property in their retirement planning.

“We’re all familiar with the phrase ‘my house is my pension’ but these headlines from our research illustrate it’s not so straightforward. Some retired people have been happy to use their property to fund their retirement and feel confident about the decision they’ve made, whereas others felt they had no choice. We want to ensure everyone has a decent income in retirement. To help them achieve this we need to understand how people factor property into their plans and we’ll be releasing the full report in a few months’ time.”

The initial findings were announced at the PLSA’s Annual Conference in Liverpool with a full report to follow. Below is a PDF of the initial findings.

|

Initial findings |

-ENDS-

NOTES TO EDITORS:

We’re the Pensions and Lifetime Savings Association; the national association with a ninety year history of helping pension professionals run better pension schemes. Our members include over 1,300 pension schemes with 20 million members and £1 trillion in assets, and over 400 businesses. They make us the voice for pensions and lifetime savings in Westminster, Whitehall and Brussels.

Our purpose is simple: to help everyone to achieve a better income in retirement. We work to get more money into retirement savings, to get more value out of those savings and to build the confidence and understanding of savers.

ABOUT THE RESEARCH

PLSA commissioned DJS Research to conduct research with 35-85 year olds in the UK looking at the use of property in retirement. These preliminary findings are from a survey with 1,653 people (1,503 online and 150 face-to-face) conducted between 21st July and 18th August 2016. Results are weighted to be reflective of age, gender, region and home ownership.

CONTACTS:

Lucy Grubb, Head of Media and PR, Pensions and Lifetime Savings Association

T: 020 7601 1726, M: 07713 073023, E: [email protected]

Babak Mayamey, PR Manager, Pensions and Lifetime Savings Association

T: 020 7601 1718, M:07825 171 446, E: [email protected]

Kathryn Mortimer, Press Officer, Pensions and Lifetime Savings Association

T: 020 7601 1748, M: 07901 007713, E: [email protected]