Help for 98,000 small businesses in Scotland facing complex pensions obligations in 2016

03 March 2016

Between 1 January 2016 and 1 April 2017 any employer with fewer than 30 members is required by law to automatically enrol1 eligible employees into a workplace pension scheme. This includes businesses which employ only one or two people, and will affect small businesses of all sectors, including over 98,4402 businesses based in Scotland. Employers must enrol any employee aged between 22 and the State Pension age, earning at least £10,000 a year and working in the UK.

Setting up automatic enrolment can be incredibly complex, even for large companies, and small businesses are just as busy and often have less experience of running a pension scheme. Pension Solution was created by the Pensions and Lifetime Savings Association (PLSA) for small businesses, in order to help them through the automatic enrolment process.

Commenting, Joanne Segars, Chief Executive, Pensions and Lifetime Savings Association, said:

“Automatic enrolment will ensure that hundreds of thousands of employees in small businesses across Scotland can access a workplace pension scheme – some for the first time. So far automatic enrolment has been a great success, but it’s important that employees of companies of all sizes can share in this success because workplace pensions are a great way to save for a good income in retirement.

“But we understand that new processes may put a strain on small businesses and that is why we created Pension Solution. It’s a service designed specifically to take small businesses through automatic enrolment step by step. It provides an impartial guide to pension providers in the market, handy templates for telling employees about automatic enrolment and reminders about what the next steps will be and when to take them.

“We also offer a free half-day training course which will help to provide small businesses with all the basic information needed to implement automatic enrolment.”

-ENDS-

NOTES TO EDITORS:

THE PENSIONS AND LIFETIME SAVINGS ASSOCIATION

We’re the Pensions and Lifetime Savings Association, the national association with a ninety-year history of helping pension professionals run better pension schemes. With the support of over 1,300 pension schemes and over 400 supporting businesses, we are the voice for pensions and lifetime savings in Westminster, Whitehall and Brussels.

Our purpose is simple: to help everyone to achieve a better income in retirement. We work to get more money into retirement savings, to get more value out of those savings and to build the confidence and understanding of savers.

NOTE 1: AUTOMATIC ENROLMENT DEFINITION

Automatic enrolment is a Government initiative to help more people save for later life through a pension scheme at work.

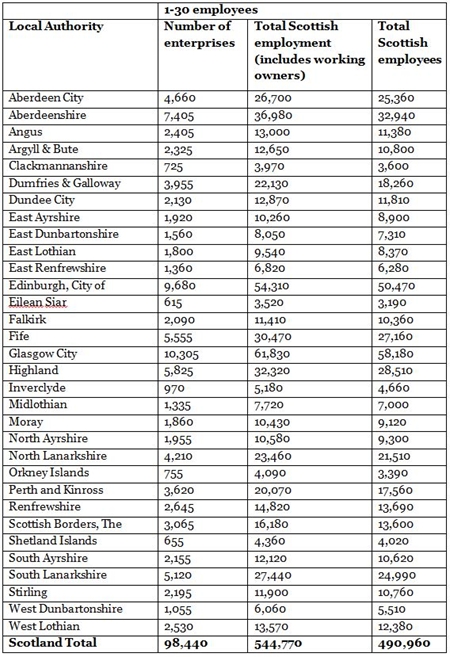

NOTE 2: NUMBER OF REGISTERED ENTERPRISES BASED IN SCOTLAND AND THEIR TOTAL SCOTTISH EMPLOYEES BY LOCAL AUTHORITY AREA

Source: The Scottish Government - Businesses in Scotland 2015

These figures exclude central and local government. The data includes the June 2002 local authority boundary changes between The City of Edinburgh & West Lothian and Glasgow City & Renfrewshire.

Each enterprise is only counted once in the local authority area it is based in.

The size band used is based on the number of employees that the enterprise employs across Scotland.

MEDIA CONTACTS FOR THE PENSIONS AND LIFETIME SAVINGS ASSOCIATION:

Lucy Grubb, Head of Media and PR, Pensions and Lifetime Savings Association

T: 020 7601 1726, M: 07713 073023, E: [email protected]

Eleanor Carric, PR Manager, Pensions and Lifetime Savings Association

T: 020 7601 1718, M: 07825 171 446, E: [email protected]

Kathryn Mortimer, Press Officer, Pensions and Lifetime Savings Association

T: 020 7601 1748, M: 07901 007 713, E: [email protected]