- LONG-TERM TRENDS CONTINUE, UPHEAVAL ON THE HORIZON

The Pensions and Lifetime Savings Association has published five year trend analysis based on 63 of its fund members (representing 2.8 million members and £243 billion in assets under management in 2015) who responded to its Annual Survey every year between 2011 and 2015. This trend data analysis is taken from a sub-sample of respondents to the full Annual Survey 2015 – headlines from which can be found in the executive summary.

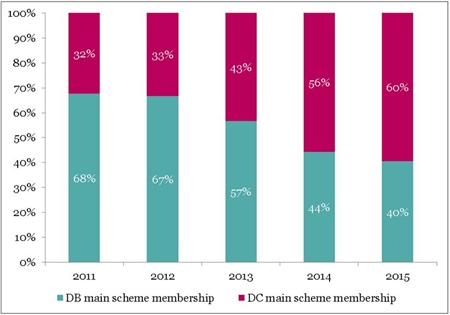

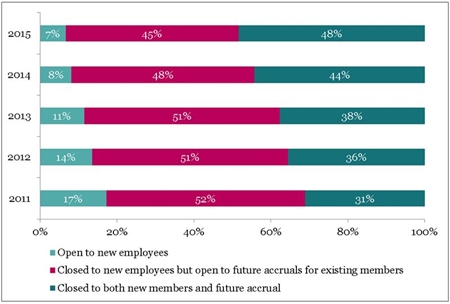

These trend data highlight the continued shift from defined benefit (DB) to defined contribution (DC) pension provision over the five years, with 60% of this sample’s active scheme membership in DC (40% in DB) compared to just 32% in 2011 (68% in DB) (footnote 1). Today almost half (48%) of DB schemes are closed to both new employees and future accrual, compared to 31% in 2011 (footnote 2).

DEFINED CONTRIBUTION

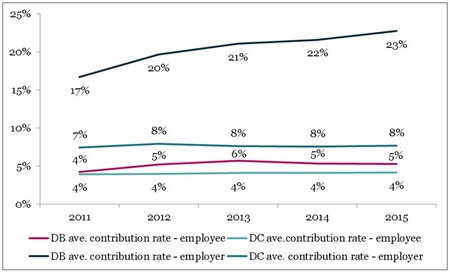

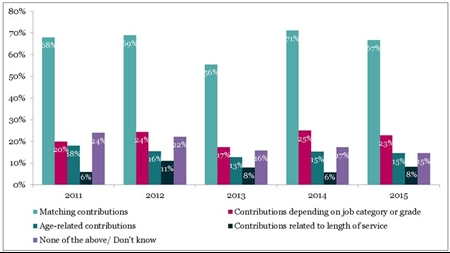

DC employer and employee contribution rates have been generally level over the last five years (footnote 3), and over this time matching contributions have been the most common contribution base (footnote 4).

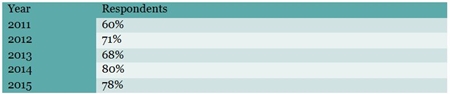

An encouraging trend is the rise of good DC governance with growing oversight of contract-based arrangements. The existence of a management or governance committee grew from 60% of contract based schemes to 78% among these respondents over the five years (footnote 5).

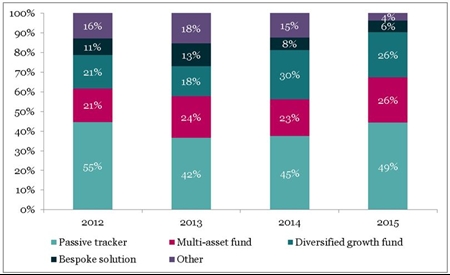

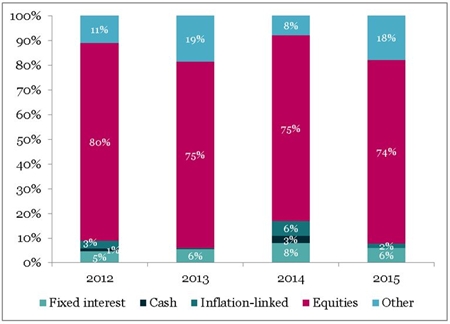

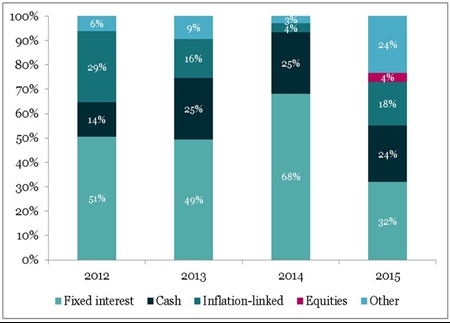

Over the last four years (question only introduced in 2012), trends in the investment strategy for the default fund are evident among these respondents. For the growth phase, passive tracker has remained the most common approach since 2012 (footnote 6) but the at retirement phase has seen a very recent shift from a focus on fixed interest, in direct response to the pension freedoms (footnote 7). Whilst it is too soon to draw any strong conclusions about asset allocation of DC default funds during at retirement phase following the reforms, this development could be an indication of the direction of travel.

DEFINED BENEFIT

The overall running costs of a DB scheme have become more expensive (footnote 8). Within the data there has been a particular jump in the average cost of administration and record keeping, which in the 2015 survey stands at £48 per member up from £29 per member in 2011. Fees to consultants have also risen to £30 per member in 2015 from £21 in 2011. However, the cost of fund management has dropped to £197 per member in 2015 down from £206 in 2011.

Also, whilst employee average contributions in DB schemes were generally level over the last five years, typical employer contributions rose to 23% in 2015, up from 17% in 2011 (footnote 3).

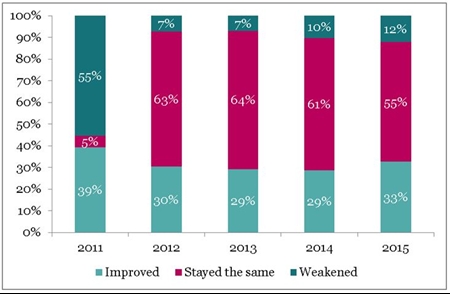

Over the last five years the strength of DB schemes’ employer covenants among this sample has largely stayed the same, or improved (footnote 9). The exception to this was at the beginning of this period in 2011 when over half (55%) of schemes reported their covenant had weakened over the last three years; almost certainly a symptom of the financial crisis of 2008-2010.

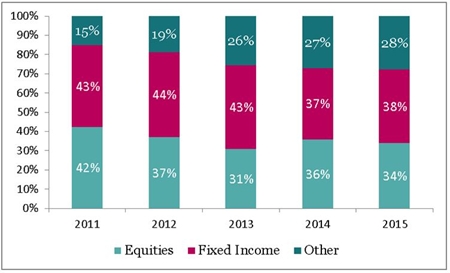

For DB schemes, the last five years have seen a shift away from equities (2011: 42% 2015: 34%) and increased diversification through investment in ‘other’ assets (2011: 15% 2015: 28%) including hedge funds and infrastructure (footnote 10).

Joanne Segars, Chief Executive, Pensions and Lifetime Savings Association, commented:

“Our trend analysis finds many of the key trends continuing – the decline of DB being an obvious example. But next year we have the end of contracting out and the possibility of further radical changes to pensions’ tax relief. The former means increasing costs and complications for DB schemes in particular. The latter in its most extreme form could completely undo the most positive change in recent years of enrolling more than five million new savers in to pensions. So it’s possible that what we’re seeing this year is merely the calm before the storm.”

-ENDS-

NOTES TO EDITORS:

FOOTNOTE 1

ACTIVE MEMBERSHIP OF MAIN DB AND DC PENSION SCHEMES

FOOTNOTE 2

IS YOUR MAIN FUNDED DEFINED BENEFITS SCHEME? …

FOOTNOTE 3

WHAT ARE THE AVERAGE CONTRIBUTION RATES PAID BY A) EMPLOYEES AND B) THE EMPLOYER FOR YOUR MAIN DEFINED BENEFIT AND/OR MAIN DEFINED CONTRIBUTION SCHEME?

FOOTNOTE 4

DOES YOUR MAIN DEFINED CONTRIBUTION SCHEME OPERATE ON ANY OF THE FOLLOWING BASES?

FOOTNOTE 5

DOES YOUR SCHEME HAVE A MANAGEMENT/GOVERNANCE COMMITTEE? THOSE ANSWERING ‘YES’

FOOTNOTE 6

HOW WOULD YOU DESCRIBE YOUR INVESTMENT STRATEGY FOR THE GROWTH PHASE OF YOUR MAIN DC SCHEME’S DEFAULT FUND

FOOTNOTE 7

ASSET ALLOCATION OF YOUR MAIN DC SCHEME’S DEFAULT FUND DURING ITS GROWTH PHASE

ASSET ALLOCATION OF YOUR MAIN DC SCHEME’S DEFAULT FUND DURING ITS ‘AT RETIREMENT’ PHASE

FOOTNOTE 8

AVERAGE CURRENT RUNNING COSTS FOR EACH OF THE FOLLOWING ACTIVITIES PER MAIN DB SCHEME MEMBER (£)

FOOTNOTE 9

HOW HAS THE STRENGTH OF YOUR EMPLOYER’S COVENANT CHANGED OVER THE LAST THREE YEARS?

FOOTNOTE 10

DB MAIN SCHEME ASSET ALLOCATION (WEIGHTED)

List of assets in ‘other’ category: property, private equity/ venture capital, hedge funds, infrastructure/ PFI/ PPP, insurance policies, commodities, cash/ short-term investments, active currency.

ABOUT THE TREND DATA ANALYSIS

This trend data analysis is based on 63 private sector respondents to the Pensions and Lifetime Savings Association’s Annual Survey each year between 2011-2015. 71% have over 5,000 scheme members and three quarters (76%) hold assets of more than £200 million.

ABOUT PENSIONS AND LIFETIME SAVINGS ASSOCIATION

We’re the Pensions and Lifetime Savings Association, the national association with a ninety-year history of helping pension professionals run better pension schemes. With the support of over 1,300 pension schemes and over 400 supporting businesses, we are the voice for pensions and lifetime savings in Westminster, Whitehall and Brussels.

Our purpose is simple: to help everyone to achieve a better income in retirement. We work to get more money into retirement savings, to get more value out of those savings and to build the confidence and understanding of savers.

CONTACTS:

Lucy Grubb, Head of Media and PR, Pensions and Lifetime Savings Association

T: 020 7601 1726, M: 07713 073023, E: [email protected]

Eleanor Carric, Press Officer, Pensions and Lifetime Savings Association

T: 020 7601 1718, M: 07825 171 446, E: [email protected]

Kathryn Mortimer, Press Officer, Pensions and Lifetime Savings Association

T: 020 7601 1748, M: 07901 007713, E: [email protected]